Bitcoin spot ETFs have been online for about 2 weeks now.

I’m going to fire Grayscale $GBTC today

I appreciate:

1) all the crypto bros who panicked back in 2023 and let me buy at an almost 50% discount.

2) @Grayscale for suing and winning against the corrupt @SECGov

I don’t appreciate:

3) the egregious management fee! 1.5%?!?! WTF?!?

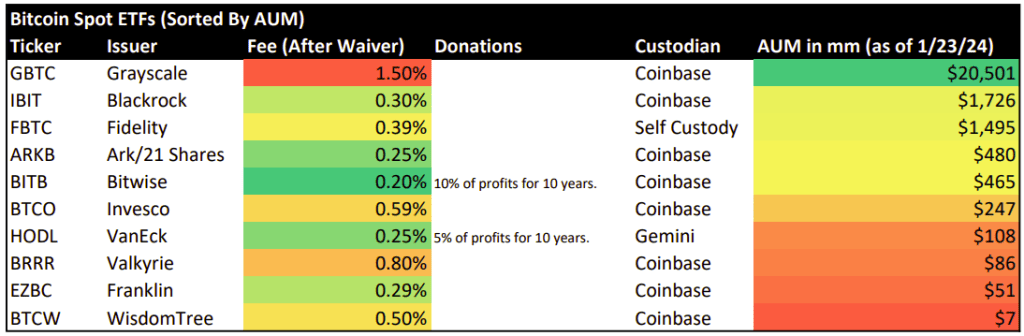

Size Matters edition!

Blackrock $IBIT and Fidelity $FBTC are the biggest of the new ones. Followed closely by Ark/21 $ARKB and Bitwise $BITB

$GBTC is the largest but shrinking quickly (see above)

The rest of the new ones are much smaller.

Fees Matters edition!

Bitwise $BITB has the lowest of the new ones. Followed closely by Ark/21 $ARKB and VanEck $HODL

Some have temporary waivers on fees (that differ from this list) which make this analysis a bit more complicated.

Giving Back edition!

Bitwise $BITB and VanEck $HODL have both stated they will donate a percentage of profits for the first 10 years to Bitcoin open-source development (via third parties).

$BITB has gathered decent AUM already.

Custodian Diversity edition!

Fidelity $FBTC does their own self custody 💪👍

VanEck $HODL uses @Gemini

If diversifying your custodian is important these are good options.

The majority of the new spot ETFs use @coinbase

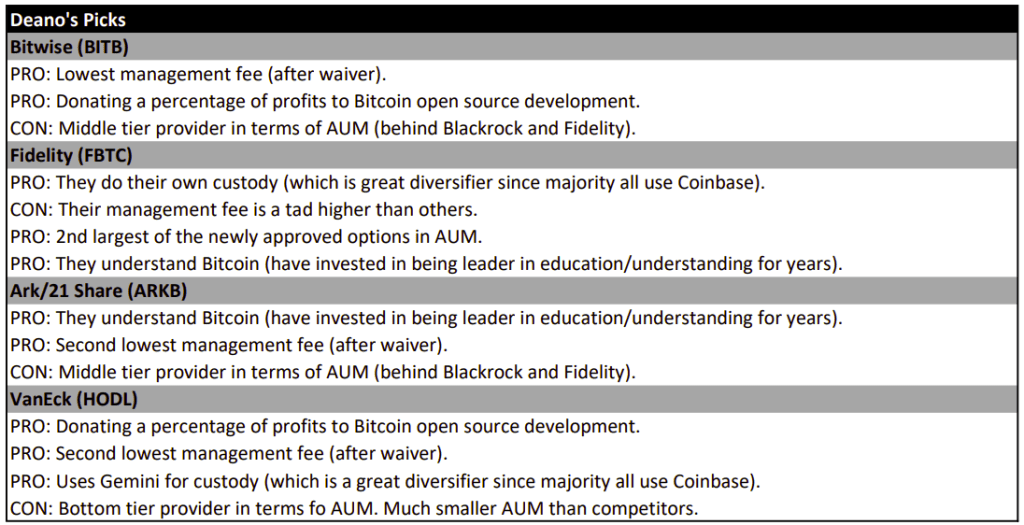

Deano’s Picks!

I’m selling all of my $GBTC They used to be the only game in town but better options now exist.

I’m going to split between (force ranked):

- Bitwise $BITB

- Fidelity $FBTC

- Ark/21 $ARKB

- VanEck $HODL

NOTE: Everything here is based on research I’ve pieced together at this time. It is all changing quickly so who knows if it is all accurate. Regardless, this is the information I am using to allocate my capital. I thought I’d share it in case it is helpful for you.

NOTE: Don’t buy a Bitcoin ETF. Just buy Bitcoin and self-custody it. HODL! But if the only option you have is a Bitcoin ETF make sure you buy a Bitcoin spot ETF (and a good one).