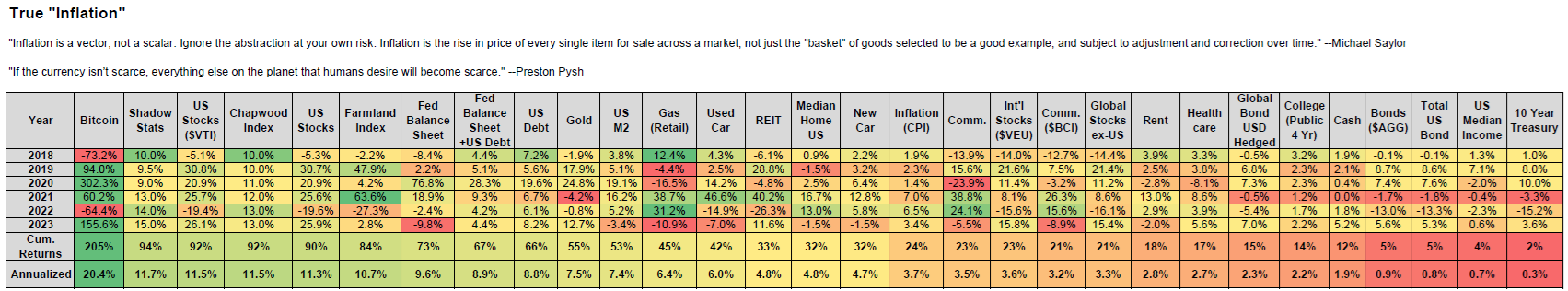

“Inflation is a vector, not a scalar. Ignore the abstraction at your own risk. Inflation is the rise in price of every single item for sale across a market, not just the “basket” of goods selected to be a good example, and subject to adjustment and correction over time.” –Michael Saylor

“If the currency isn’t scarce, everything else on the planet that humans desire will become scarce.” –Preston Pysh

I wanted to know how ‘everything/everyone’ is being impacted by recent inflation and how well Bitcoin is protecting me.

You can download a PDF of this graphic (which is a bit easier to read…maybe).

Methodology

I looked at 6 years of data for all kinds of things to figure out how they have performed relative to each other.

I look at various inflation calculations, asset classes, large expense items, government spending, and incomes.

I then force-rank the annualized returns.

CPI Is A Lie!

It is easy to see CPI is a lie! The Kleptocrats want you to believe that inflation has been 3.7% over the past 6 years.

Meanwhile, ShadowStats (CPI using 80s and 90s formulas minus modern hedonic adjustments) and Chapwood (500 items across 50 metros) are 11%+

Printing Money Ain’t Good!

What else are the Kleptocrats lying about?

Government Spending and Money Printing

The MMT’ers say it doesn’t matter.

They must believe it too.

The US Debt is growing at 8.8% and the Fed’s Balance Sheet is growing at 9.6%.

M2 is growing at 7.4%

These are all massive $ items.

Wage Earners = Losers!

If you are a wage earner you are losing Big Time!

Median income in the US has increased .7%

It is one of the worst things on the page.

As everything is getting more and more expensive the wage earner will fall further and further behind (ALL OF IT).

Investments: Bonds

Imagine owning bonds!

As inflation is running between 4% and 11% and everything else is going up within that range bond holders are getting REKT!

Most bonds haven’t broken 1% annualized.

Certificates of Confiscation!

Investments: Stocks

People who owns stocks “feel” rich because their stocks have gone up. US Stocks are running 11%.

The problem is some of the inflation models are growing just as quickly.

So, even though your stocks are going up you aren’t REALLY getting any richer. 😦

Investments: Real Estate

They ain’t making any more land! Farmland has done well at 10.7%.

But REITS, Median Homes, and Rents are not doing as well (between 4.8% and 2.8%).

So, you are likely losing “ground” if you buy ground!

Investments: Gold

The little pet rock has done fine at 7.5%.

It is the complete opposite of fiat money and fiat money printers. God’s money, sound money, real money.

The gold bugs might be onto something.

Investments: Bitcoin

The only asset class that has outpaced everything is Bitcoin. 20%!

Good, because that is what Bitcoin is supposed to do.

Since it is the most scarce of everything on this list that should continue (especially if @PrestonPysh is correct in his quote).

Sharing Is Caring!

I’ve wrestled with how to visualize all this for a few years and I finally figured it out.

I thought I’d share it because it might be helpful for others to see the same information all on one page (it is a lot to cram onto a page).