https://x.com/VisualCap/status/1820807312426037545

This link contains a great little graphic that shows the power of early life savings…be sure to pause it right at the end and take in the final results. Look how important the 20s are!

Just like when ya’ll were little kids, remember saving a little (or a lot) can add up quickly. Get the full match/free money your employer gives you (always). The best kind of money is free money (don’t leave it on the table). Save in tax-advantaged accounts (401k, IRA, Rollover IRAs, HSA) if you plan to stay in the tax-happy USA. Because when you wind up with a lot of money later in life the tax man will do his best to take it from you (and he is VERY good at it). I’ve paid more money to the tax man than anyone else over my lifetime and would pay a lot more if I hadn’t worked and planned hard to not pay him. He can get f’d!

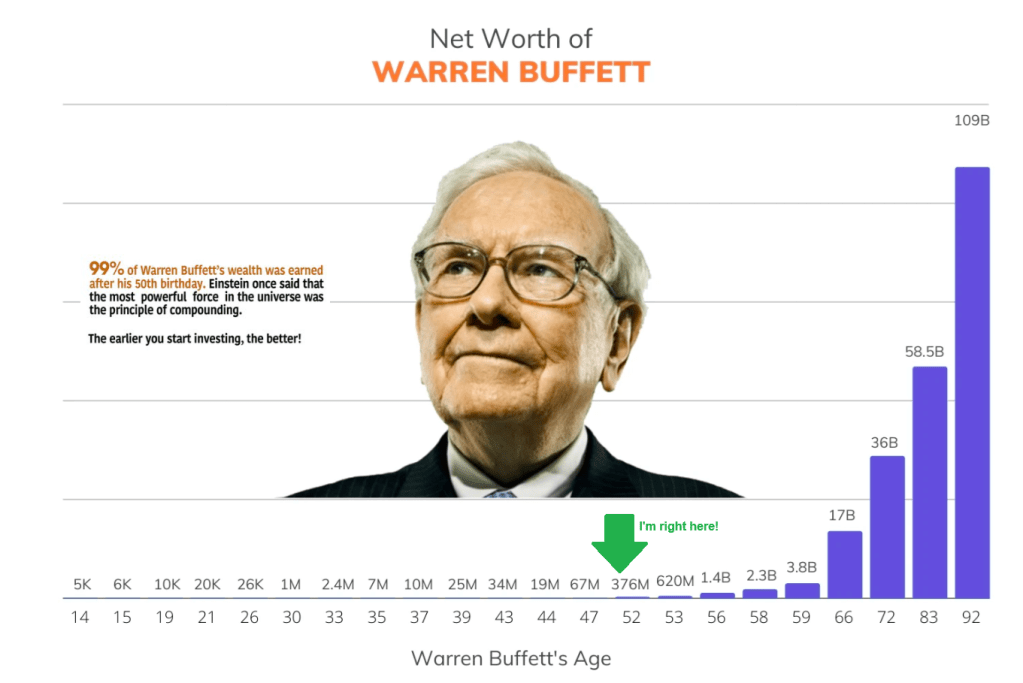

Also, it won’t be exciting putting 5%-10% into an account and watching it bounce around up and down. It’ll seem like it is just sitting there not doing much at times or (yikes) going down! But, if you do it for a while and keep doing it you’ll soon have your annual salary in there and it’ll be more fun. Then keep doing it and soon you’ll see it start to go up and down by the amount of your annual salary over the course of a year. Then you might see it move by your weekly/monthly paycheck in a month, a week, or even a day. Mine went down by half my annual salary just YESTERDAY?!? YIKES! LOL! When you are crying you should be buying, when you are yelling you should be selling!

There are also charts going around that show how much of Warren Buffett’s wealth was built late in life. See attached. 99% of his wealth was created after his 50th birthday. He had around $350 million at 50 and has $109 billion now. 311x! It is because he started early in life (started investing at age 14 just like ya’ll did). And he has lived into his late 90s. That is over 80 years of compounding wealth (and fighting the tax man, which he did well).

Life gets a lot easier when your saved wealth earns more money than you can. When it begins to grow faster than you can spend it.

So hang in there and do what you can as hard as you can and you’ll look back one day and be glad you did. Live like no other so that you can live like no other.

Love ya’ll,

Dad

PS – I can’t believe ya’ll don’t have Quicken installed to track all this! (hint, hint)