Yes, it is 20 pages…

No, you won’t read it…

PS – I’ll share it anyway.

PPS – I can still be fun at parties despite being a super nerd.

If you’d rather download a PDF to read this you can do that here:

Part 1 – 4 Years In…

“Don’t tell me what you think, tell me what you have in your portfolio.” ― Nassim Taleb

I’ve been interested in investing my entire life (I’m 48). I remember looking at Value Line pages for IBM stock (?!?) and learning LOTUS 123 spreadsheet program back in high school. I graduated college with a finance degree and entered the workforce in an investment performance reporting startup. Through my time with Investment Scorecard I learned the value of monitoring one’s performance against relative benchmarks. I don’t work in the finance industry anymore but I still think about investing A LOT!

I’ve been investing for several decades. Most of the time in index funds/ETFs but I’ve also bought individual stocks at times as well. When my son got interested in investing and wanted to start picking stocks a little over 4 years ago the first words out of my mouth were ’too much work’ and ‘you can’t beat the market’. Don’t ask me how I know!?! He, like many, disagreed and wanted to give it a shot. I was not particularly happy with how my investments were allocated at that time and wanted to make some changes as well. So, we dove in. I did it the only way I know how to do things…like a madman! Over the past four years, I have, at times, taken a pretty aggressive all-in approach to my investing. There have been times where I’ve invested pretty much my entire portfolio in individual stocks. I’ve changed courses a few times in unexpected ways. It has been fun and I have learned a great deal on many fronts.

Somewhere along the way, I discovered #fintwit (people on Twitter who regularly talk investing related topics). I also discovered investing-related podcasts. This has been a real game-changer as I’ve learned a great deal from both. I wrote about my favorite podcasts here: https://deanorolls.com/podcasts/

Somewhere else along the way I decided to start writing everything I was doing down and publishing it to my website. I’ve been tracking, in detail, my investments for 48 months this month and publishing them for all the world to see. I’ve been calculating my performance against the markets and publishing it to my Twitter feed and website for all 48 months. I’ve learned a ton along the way (about myself, my methodologies, and investing in general). Writing things down has also been a game-changer. I’ve been writing down my thoughts in detail as I felt compelled. Sometimes it has been monthly, sometimes quarterly. Now I write when I think there is something to say. No one particularly gives a hoot about me or my money but the discipline of noodling on things and then writing down the thoughts regularly has been extremely helpful. It has also been excellent to be able to come back later and easily remember why I did a particular thing I did. I do this solely for myself but if you are interested you can read more here: https://deanorolls.com/investing/

I write it down for myself more than for anyone else. It is fantastic to go back and read why I did what I did when I did it. Many times after the fact you can easily convince yourself why you were brilliant or a dunce about a particular investment decision. Sometimes things work out as you thought they would and other times things happen that you didn’t plan for (or that no one could plan for). Writing something down forces you to fully understand what you are writing. You can’t fake it. If you write something down that is stupid someone might read it and think you are stupid. Writing things down and putting them on the internet forces me to be accountable for why I made a particular decision. Calculating my performance each month forces me to reconcile if my decisions are working. Writing it down doesn’t allow me to change my story after the fact depending on whether I was right or wrong. I have to be accountable for my decisions. This forces me to make better decisions.

I have a long-time frame. I’m not managing my capital for current income but for long-term growth. I’m not a trader (although I’m not afraid to trade…and have). I’m managing my capital to grow it over time and not have any significant impairment to it. To do this I need to:

- Allocate Capital Well

Everything is cyclical in the world and things ebb and flow (sometimes wildly). Asset classes can outperform and underperform each other and their longer-term averages for long periods. I’ve learned that most great capital allocators usually make some incredible call that makes them look brilliant but then eventually revert to the mean over time. I do believe a person can tilt their portfolio towards/away from particular asset classes at times to generate some alpha. I do not believe anyone can do this consistently. Some of those great capital allocators simply got lucky. Most of them are unable to replicate their success. I allocate capital based on a plan. I have a very sophisticated methodology that no one could understand. “When you are crying, you should be buying. When you are yelling, you should be selling”. Super complex! There have been times I have made big changes in my portfolio. I generally try not to do this (and do it less and less the more I learn). When I want to make a tactical allocation (because I’m feeling smart about something) I express this with an overweight/underweight. This approach lets me get whatever is nagging me out of my brain and implemented without making wild swings in my approach. I think this is wise. I generally am prepared to live with whatever allocation I have through thick or thin come what may! I allow myself to course-correct as things play out but I generally am prepared mentally to weather things going as expected or things not going as expected. No one knows how any of it will turn out so no one should be surprised when things don’t go the way you expect.

- Be Well Diversified

I struggle with this one, always have. I’ll read and study and come up with an opinion on what I think is going to happen. Once I do this, I find it very hard not to express my opinion within my investment portfolio. I have made drastic reallocations in the past at times. Each time I do it I tell myself I’ll not do that again. It is not worth the risks. But I can’t help myself at times. Within the past 4 years, there have been times I have been 100% stocks (individual stocks). I don’t suggest anyone do this. Hell, I don’t suggest I do this?!?! I did it anyway! Regardless, I have to keep asking myself “what happens if I’m wrong?” I’m wrong a lot about a lot of things. Why do I somehow convince myself that I’m going to be right this time? It makes no sense. We are sometimes our own worst enemy and each of us has biases and weaknesses that we don’t even know we have (or that we know we have and still can’t stop). For that reason, it is important to be diversified. There are things in my portfolio right now that I do not want to own. I think they are stupid and that there are better things to own. “What happens if I’m wrong?” There are things in my portfolio that I’ve researched and I cannot fathom a way they don’t work out very well. I want to own MUCH more of those. “What happens if I’m wrong?” There are things that I detest so much that I absolutely won’t hold them in my portfolio. Plenty of other people on the planet own them and do just fine. I don’t care, I’m not going to own them. “What happens if I’m wrong?” That question is the way I make sure I stay diversified. Sometimes it will keep me sane and other times I am so pig-headed that I don’t let the answer divert me from what I’m setting out to do. Sometimes it works out well and sometimes it doesn’t. It has helped me greatly however over the years to make better decisions. I might not get every last drop of a good idea, but I also don’t get every last drop of a bad idea either. Investing over a long period without serious impairment to your capital is a sure way to win. Being diversified is the best way to do that. It keeps you from being your own worst enemy.

- Equal/Outperform Appropriate Benchmarks (And Inflation)

You need to always know who you are competing against and to make sure you are measuring up over time. This is an area where I really nerd out since I worked at a company that did this for over a decade. I know what appropriate indexes to use to make sure my portfolio is performing the way it needs to over time. If I beat an index for a year or two and then lose for a year or two it doesn’t matter to me. I’ll only be able to tell if I made good decisions after 5, 10, 15, 20+ years. Therein lies part of the problem. An investor doesn’t know if what they are doing is successful until many years later. At that point, it is too late to make changes/recover. Investing is a hard business. No lie! My goal is to outperform my indexes but this is very hard to do. Many try…many fail. I’ll be very happy if I do that. I’ll be satisfied if I can simply perform in line with my indexes. Inflation is everyone’s ultimate index/benchmark. I don’t think about inflation as one single thing but a variety of things. I try to outpace the inflation monster at all times. My portfolio has a long time horizon and a strong tilt toward fighting inflation.

- Manage Investment Fees And Expenses

One thing I can control is the type of investment vehicles I choose to own (and the fees and expenses they pay). Some assets are easy to own, widely available, and easy to find low fee alternatives (like a stock index ETF). Sometimes a specific account doesn’t contain the exact vehicle you’d like to own to express your investment thesis. Sometimes the particular thing you need to do to express your thesis isn’t easy to own, isn’t widely available, and isn’t easy to find a low fee alternative. Regardless, you still need the exposure so you have to do the best you can. Things are always changing and often quickly. I remember not too long ago you had to pay a commission to buy/sell a stock?!? OK, Boomer!?! I try to always do the best I can to manage my fees and expenses in the investments I make.

- Account Minimum Balance Fees – You only pay these if your account balance is below a certain amount. Don’t open a bunch of accounts with low balances.

- Transaction Commissions – Transaction-related; you only pay these when you have a transaction. They can be flat-rate commissions or value-based commissions. Examples: Buying/selling stocks or bonds or selling real estate. The best way to mitigate transaction commissions is to simply not trade (unless there are no fees). This also helps with taxes so it is a win-win. You can also choose providers, accounts, investments that have low or no fees associated with them. Shop around and find the most cost-effective way to do what you are trying to do.

- Annual Expense Ratios – You pay these each year whether you make money or lose money. These are the gift that keeps on TAKING! These are usually associated with mutual funds, ETFs, and certain types of investment accounts. They are annual fees charged to all fund holders. Includes 12b-1 fees, management fees, administrative fees, and operating costs. All these are rolled up into the asset’s annual expense ratio. This number is already deducted from the assets’ stated return. So if the asset says they returned 12% that number already has the annual expense ratio deducted from it. You pay these amounts whether the asset goes up or down…EVERY…SINGLE…YEAR! Ways to mitigate these fees:

- Buy Index Funds/ETFs – The annual expense ratio on these assets are most often a fraction of their active management counterparts. Let the machines run your life!

- Make Sure Returns Make Fees Worth It – If you are choosing active management make sure you know your reason and be sure the extra fees are worth it. Don’t let a closet indexing asset manager drive a Ferrari with your hard-earned money!

- Certain Types Of Investment Accounts Have These Too – Mutual funds and ETFs have these fees…so do certain other types of investments/investment accounts. These are almost always a very expensive way to invest (and have an appropriately sized sales job and financial voodoo attached to them). You don’t need it!

- Manage Investment Taxes

“In this world, nothing can be said to be certain, except death and taxes.” – Benjamin Franklin I’d argue that the that last one, tax management, is the most important item with regards to wealth management to grow (ie keep) one’s capital over time. I’d also argue that few investors place that high of a value on managing taxes. If an investor is not managing their taxes well they are likely wiping out all the work they’ve done on 1-4. I’ve thought extensively about how to manage my investment taxes for them to have the least possible impact on my investment portfolio.

- Coffee Can Investing – One of the best ways to reduce taxes in investing is to do less transacting. I try to follow a coffee can approach in most areas. When I have new capital to allocate I try to find the area of my portfolio where I can invest and get the most value. Then I invest the money and try not to touch it again. Of course, if I need to transact I will but I try to minimize it as much as possible.

- Tax-Advantaged Accounts – I try to get the maximum amount of money I can into tax-advantaged accounts (401k, Roth IRA/Conventional IRA, HSA, etc.). Doing this takes taxes completely out of the equation. I’m not going to be touching this money anyway so I don’t mind not being able to get to it until retirement.

- Use Capital Gains Rate – If I have to transact I do it at the long-term rate (capital gains rate) versus the short-term rate (ordinary income rate). Depending on one’s tax bracket (which top out at 37%) this can be a substantial difference in the amount that goes towards taxes (since the long-term rate is between 15-20%).

- Choose Tax Efficient Vehicles – When I choose investments I make sure I choose very tax-efficient investment vehicles. I look for investments with 1) low turnover, 2) index-based, and 3) ETF-based (versus fund-based). Doing all these things allows me to keep Uncle Sam from picking my pocket.

That is what I set out to do with my efforts. As I cross the 4-year mark I think it is appropriate for me to take a temperature check and jot down my thoughts…again…for myself. If you are here and reading this I hope you might find some value in it.

I’m going to write this in five parts:

- Part 1 – 4 Years In…

- Part 2 – My Current Guiding Thesis

- Part 3 – My Current Asset Allocation

- Part 4 – My Investment Performance

- Part 5 – What’s Next?

Part 2 – My Current Guiding Thesis

I continue to believe that the ONLY thing driving anyone’s investment portfolio these days is the manipulated fiat currency and manipulated interest rates in our financial system. Our entire system’s money is broken. The leaders who are pulling the levers have lost their collective minds. Anyone with half a brain in their head can look at the current situation and realize it is completely off the rails and is careening out of control. Every government on earth is printing money out of thin air and dumping it. Wherever it lands we see valuations/prices rocket higher. Global fiat money is an unprecedented experiment that has never occurred in modern human history. Not one person on earth knows what is going to happen. I have some thoughts, however!

I’ve felt like the financial system has been moving in a really bad direction ever since the 2008 financial crisis. When the policy to print money (QE) and peg rates at zero was implemented and left in place for over a decade, I knew this was not a good thing. When I started focusing on my investments back in late 2017, I was anxious about it and the impact it was going to have on my life/wealth. I had been anxious for some time (nearly a decade). That said, I had no clue what to do about it. As the markets powered to new highs in 2018 I began to de-risk my portfolio (by moving some capital into bonds). I remained in this mode for most of 2018-19. When COVID hit and the markets got hammered in early 2020 and I witnessed the policy response I quickly realized that what was likely coming was going to make 2008 look like a cakewalk. The policymakers bluntly state that they are going to keep doing what they are doing indefinitely (and in larger amounts). We’ve crossed the rubicon from uncharted waters (of 2008-2019) into COMPLETELY uncharted waters where every single government on earth is debasing their currency at the fastest pace ever. My translation is they are going to print the currency into oblivion. I don’t believe they have a choice. I believe any asset that is fiat-based (or a fiat derivative) is the worst place you can have any money held. Bonds, in my opinion, could easily be renamed Certificates of Confiscation. I was sitting on very little cash anyway but I had a bond position. I began closing out my bond position aggressively at this point. By the end of 2020, I’d closed it out completely. I’ve reallocated this capital into mainly commodities and Bitcoin. I’m not sure this is a good answer to all this…but…in my mind, it must be done.

Back in February 2020, I watched my portfolio get clobbered due to COVID (it dropped 16%+ in one month, March, to cap off a 25%+ drop over a couple of months). This was to be expected. Our response to the virus was to shut down the world.

The fiscal response was fairly massive–the $2.2 trillion CARES Act. Forgivable PPP loans (mostly going to wealthy people) of $1.9 trillion, a direct stimulus of $300 billion, and $260 billion in enhanced unemployment. In late 2020 another $900 billion in stimulus was passed. In March 2021 another $1.9 trillion in stimulus and enhanced unemployment was rolled out. Keep in mind COVID was over at this point (but we were still paying people to stay home regardless for most of 2021). Asinine! 4 TRILLION DOLLARS printed out of thin air in total…SO FAR! All this spending was deficit spending without any way to pay for it…it was printed from thin air.

Meanwhile, the Federal Reserve cranked up all their programs again (QE / rate adjustments / changing capital requirements / REPO / Reverse REPO / Etc.). When COVID hit in early 2020 they had a balance sheet of around $4 trillion. By June 2020 it was up to $7 trillion. Since that time, it has risen to $8.5 trillion. They’ve done this while dropping rates in March 2020 back to zero from around 2% before that. Rates are still there…unmoved. I remember hearing a speech where they said [paraphrasing] “we are going to print as much as is needed and keep rates low indefinitely with no plan to raise them.” Since then they have implemented program after program to keep the system from seizing up from lack of liquidity. No one on earth wants to buy a US Bond. That’s fine, we’ll buy them with printed money…again…printed from thin air. They’ve kept their promise. Every once in a while they’ll hint at tightening their policy, but they are not going to tighten anything. They can’t. They are trapped with rates at the zero bound and with the only liquidity coming from printing. The free and open system is completely offline.

By April 2020 I’d figured out they were going to print the currency into oblivion. I didn’t agree with it, but it was clear that is exactly what they were going to do (and had been doing). They were doing it and telling us they were going to continue to do it. I believe them! I was allocated to bonds to save up for a rainy day. The plan was to not be 100% allocated to highly valued assets and to have a little safety net in something less risky and less highly valued (ie overvalued). This is the exact wrong way to be positioned in this type of environment. I began selling those bonds and shifting my portfolio towards risk assets. The last thing I wanted to own in this environment were Certificates of Confiscation (bonds).

By August 2020 I was convinced that PPP loan forgiveness would drive asset prices through the roof. Rich people having their balance sheets cleaned up courtesy of the government would make asset prices rise. $1.9 trillion of fresh balance sheet room would go a long way. I got much more aggressive in my shift towards risk assets (and away from bonds).

By December 2020 I’d completed the reallocation of my entire portfolio to face the world we were in. I was “Uncomfortably Long Assets”. I knew/know the ride will be bumpy but I suspect it is the only way to survive what is coming. So far, I haven’t been wrong.

Our money is broken! The people who are responsible for making sure the fiat money is looked after have lost their collective minds. Interest rates are broken! The people responsible for setting the “risk-free rate” (which really should not even be set by any humans anyway) that every other cost of capital is based on have lost their collective minds. You can’t monkey with both these things and have a functioning economy. Imbalances and absurdities will occur more frequently until everything ultimately breaks down and resets in some way. I don’t make the rules! I’m just trying to survive!

I believe policymakers are trapped at this point. They’ve crossed the Rubicon and cannot return. No one can raise rates without collapsing the system. Anytime a problem arises the solution will be to print more money and the amounts will get alarmingly higher and higher each time (because they’ll have less and less impact). This will exacerbate inequality and division. It will likely lead to more and more populism (with extreme measures taken to prevent it).

We’ve lost all common sense and we believe we are smarter than the system we’ve created. We are, of course, completely wrong as we will find out soon enough. Every fiat currency system ever devised by man eventually dissolves in this way. Ours will be no different. I’m positive and hopeful that common sense will return to our world and our financial system one day soon. I’m not sure if it will happen without substantial pain for many involved. I don’t see how it can, alas I’m hopeful because I see a way for it to resolve itself in a way that leaves us in a better position. That is about all we can hope for in my opinion. If I’m wrong about the direction I don’t think it will be a good thing for anyone involved. We’ll see.

I didn’t come up with all this ‘theory’ on my own. Over the years I’ve listened to many smart people discuss ideas/theories on all things macro. I think most of it is hogwash. Not anyone knows what will happen. There are a few people that I believe have the situation pegged, however. Preston Pysh, Lyn Alden, Luke Gromen, Jeff Booth, Greg Foss, Michael Saylor, and Saifedean Ammous all come to mind. Preston sums it up very quickly here: https://www.theinvestorspodcast.com/business/inflation-and-deflation/ The only things about macroeconomics I know for sure:

- All fiat currencies are going to debase. It is math (Greg Foss). I don’t want dollarized assets.

- All technology is deflationary over time (Jeff Booth). We will do more with less and it will continually revolutionize our world.

- Change happens exponentially (also Jeff Booth). Our little humans minds cannot comprehend exponential change. We fight it, as we often fight any new technology.

All these things happen over longer periods of time or they happen so fast that our minds can’t comprehend them. They fool us into thinking they are not happening. But they are and each is inevitable so we should plan for them to happen. Therefore, I remain ‘uncomfortably long’ assets. Back in late 2020, I decided to get very uncomfortable. I would much prefer to be more conservative and ‘safely’ ride out whatever happens. I believe, however, if I do that it might wind up being devastating to my investment portfolio (and net worth). Risk ON = very uncomfortably! I wrote about it here: https://deanorolls.com/2020/12/01/im-uncomfortably-long-assets/. The past year has produced wild volatility in my investment portfolio. I expect there will be more of that in the coming years. My bet is it is going to remain VERY uncomfortable! The fiat money we use is broken and becoming worthless. This is driving all kinds of distortions in all kinds of things (interest rate manipulation, asset prices, home prices, land prices, consumer prices, labor prices, wealth inequality, etc.). I don’t think it ends well or at least without consequence. Regardless, I know I need to

- stay as far away from fiat derivative assets as possible and

- prepare for a wild ride. I’d much rather not do this (which is why it will be uncomfortable).

That said, I don’t see an alternative that works out well over the long term. Watching my portfolio gyrate wildly is the price I must pay to remove myself from the “safety” of watching my portfolio not gyrate wildly but have its purchasing power rapidly eroded. I think people who didn’t have assets got left behind after 2008. Likewise, I feel like if you don’t have assets as of mid-2020 your wealth is being obliterated. This is most impactful for those with less wealth (furthering the wealth inequality divide). Things in the world are going up in price faster than you can earn to keep up. I feel like this in my own life. I don’t think I am alone. Good luck out there!

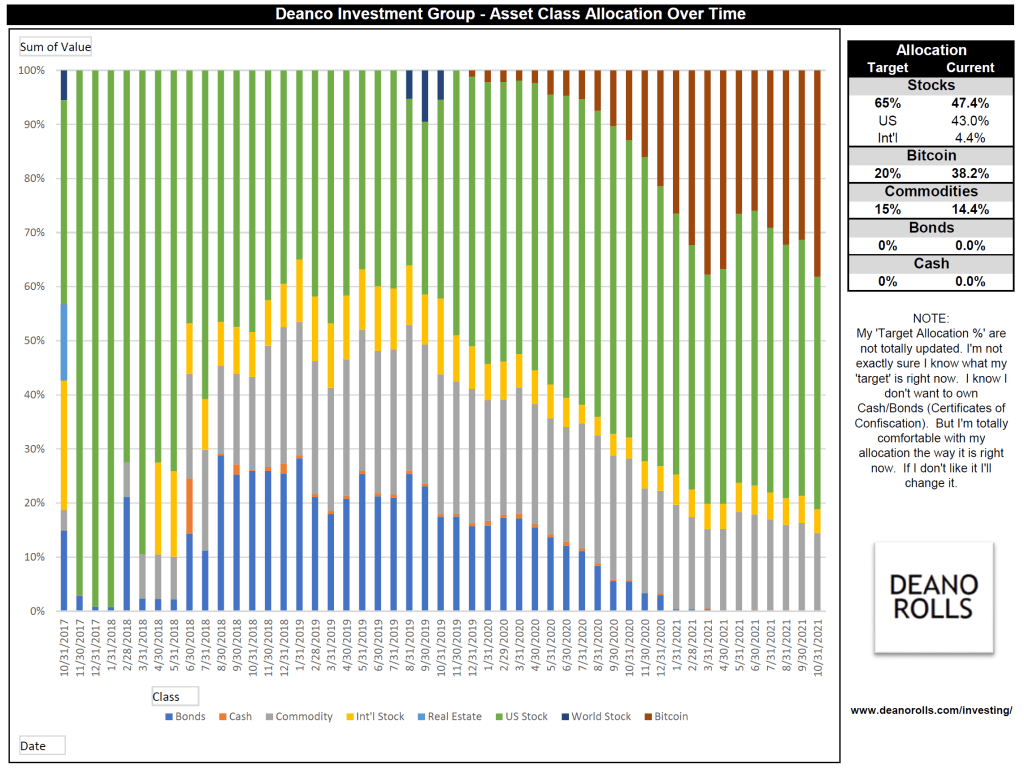

Part 3 – My Current Asset Allocation

I’m not sure I know exactly what my target allocation needs to be right now. I can say that how I am allocated currently has me “less worried” than I have been in years. I sleep like a baby with this portfolio allocation. Even during the March 2020, COVID-related drawdowns, I was not stressed much at all (even with a 25%+ drawdown in a very short timeframe). That hasn’t always been the case across the 48 months I’ve been tracking it (and before). At my age, I feel like I should push my stock allocation higher. Having less than 60% of my portfolio allocated to stock is stupid and doesn’t feel right. I’d honestly much rather have 100% of my portfolio in stocks. Stocks, however, are more closely fiat derivative than other assets in my portfolio. This has driven their valuations alarmingly high. My safety play is commodities and Bitcoin. I’ll likely underperform stocks over time but I take this trade-off to be a bit more diversified. Remember how earlier I mentioned how I struggle with this? This is why!

- Stocks (47%) – My desire is to be heavily allocated to equities at all times. I am a stock guy. I believe stock ownership is the best way to stay ahead of the inflation monster over long periods. The only reason I would allocate money away from equities is if I held an alternative investment/asset class due to my current thinking on a subject (overvalued equities, recession risks, better value, etc.). Truth be told I would be fine owning 100% stocks. Over time they are the best performing asset class. And since growing my net worth is what I’m all about I ‘should’ have 100% of my net worth allocated to stocks. The stated goal of Deanco Investment “Group” is to beat the stock market over time. This has been incredibly hard over the past 4 years but it is still the goal. I won’t know if I did it until I’m nearly dead. We’ll see!

- US Stocks (43%) – I generally invest in US Stocks (especially when I’m buying individual equities). I limit my positions to only US Stocks to eliminate the currency risks that I am not trying to manage (but that could have a huge impact on my USD returns). If I am unable to find individual US Stocks to purchase, I will generally invest in Fidelity sector ETF funds to maintain the appropriate sector allocations (https://deanorolls.com/2019/11/01/fidelity-sector-etfs/). At this point, however, I’ve made the decision not to own any individual US stocks. Within my stock asset class, I’ve moved to a methodology where I try to keep my portfolio sector allocations matching the 25-year average of the S&P 500 index. I do this to level out when certain sectors get a bit frothy (and start taking a larger weighting) and vice versa. This is effectively market cap-weighted indexing with a twist. I think market-cap-weighted indexes are unwise in general but they are extremely: 1) tax-efficient and 2) low costs. I think those two things matter more than most other characteristics (where they are lacking). I tweak this part of my portfolio in a few minutes each month. It takes SUBSTANTIALLY less time to administer each month than individual stock picking takes. I suspect it will perform fine (and maybe better). I wrote about this change in strategy here: https://deanorolls.com/2019/12/08/the-top-things-i-learned-or-relearned-about-investing-over-the-past-2-years/

- International Stocks (4%) – There is one investment account that I have (a tax-efficient account) where my investment options are not all that great. Two good ETF options in this account allow me to allocate to international equities and emerging markets equities. I’m not too sure that ‘home country bias’ matters to me. I understand the concept but believe that sector allocation and currency exposure matter more than anything related to home country bias. In case I am wrong, I’ll use this account’s two good options to allocate to these. I’ll just keep maxing out my contribution to this account over time (into these two investments).

- Bitcoin (38%) – Bitcoin remains my largest individual portfolio position (and the only position I am adding to at this time). I’ve spent considerable time/energy learning about it. I think a lot of people should do the same. I’ve added to my original position several times (as I learn more and more). I revisited this decision in March 2021 (as it was trading near all-time highs). I wrote about it here: https://deanorolls.com/2021/03/09/bitcoin-do-i-still-want-to-own-it/. Since then, it went down around 50%, then rose back to all-time highs. I have not changed my mind at all. Some of the smartest people I know believe in it and are working to drive the Bitcoin protocol forward. I believe it is one of the few remaining good options available for the vast majority of the population in this fiat denominated world. I regularly get choked up listening to technologists and leaders in the space talk about the impact it is already having on the lives of normal people just trying to get by. The vast majority of humans on this planet have no way to store/protect their wealth (in case you didn’t live in America…like most don’t). The open-source Bitcoin protocol is the most perfect solution to this problem. Bitcoin is for billions…not billionaires! Michael Saylor recently tweeted: “A person should not be required to speculate on central bank policy, boardroom politics, competitive dynamics, technology trends, regulatory interference, congressional politics, labor relations, litigation, and nation-state conflicts just to preserve their life savings. #Bitcoin”. I couldn’t sum it up better myself. Do what you want, I don’t care. I’ll just be over here, living my life, and storing my life force in Bitcoin. AND THAT IS ENOUGH/OK!

- 100% Bitcoin Portfolio – I’ve seriously considered selling every asset class and putting all the money into Bitcoin. Earn money, save money, and store the money in Bitcoin (the hardest money on earth). Investing in stocks and other asset classes is being done to outpace inflation. What happens if your money is not being deflated? You don’t need to do that. All you need to do in that environment is work and earn and save. This is the concept of being on a Bitcoin Standard. You simply save what you earn to spend later when you need it. It is a hell of a concept?!? Much too simple for our world. So we are where we are. I’ve mentioned how I struggle with being diversified when I come to a particular thesis. This one resonates with me and I believe I should do it. I’m going to remain more diversified than I would like, however, because I know I need to do that. Again, “What if I am wrong?” Narrator: He isn’t!

- Other Crypto Assets – I believe the crypto asset class is real and that it will be enormous. I believe it will ultimately consume a great deal of monetary energy. There is so much going on in the space that will transform the way our financial system and lives work. I think all this has huge value. To date, I have only expressed this opinion via owning Bitcoin. I do believe it will be the most valuable of all the assets in the crypto world when it is all said and done. It has been hard for me to keep up my understanding of just this space. I’m behind the curve on the remaining crypto space. I’m currently working to make sure I understand everything else going on enough to not have huge blind spots. I’m particularly interested in Ethereum (and other similar protocols). I see how that ecosystem becomes worth a great deal to humanity. I also see how it could fail miserably (although highly unlikely). Regardless, there are all kinds of things to consider: Defi (decentralized finance), remittance/payments (altcoins, stable coins, central bank digital currencies), metaverse, smart contracts, tokenization (existing assets and social tokens), NFTs, etc. Perhaps I’ll pull the trigger and invest in one or some of these. Perhaps I’ll play around with them to learn more. Perhaps I’ll just continue to hold Bitcoin. I think the crypto space will grow much, much larger than the current $2 trillion value. I believe it will become many multiples of that. If all I do is HODL some Bitcoin the rising tide is going to raise all ships. I’ll be fine. Could I make more somewhere else or use a different strategy? Perhaps, but I’m not overly concerned about that risk.

- Bitcoin ETFs – Huge…gotta be good…right?!? The world is waking up to Bitcoin. Regulations are rapidly evolving and products are coming to market that will allow greater numbers of people to allocate capital to Bitcoin. One of the reasons adoption has been limited to date is because many traditional institutions are not able to allocate capital to it (their actual institutional mandate makes it impossible). Many people’s accounts have no option to move their capital into it. As regulations change and more options become available it will have both pros and cons. I think newly released Bitcoin ETFs (currently based on derivative markets) are a horrible way to gain an allocation to the space. All the same, problems that plague my broad basket commodity ETF are present here (high cost of ownership both from fees and contract roll). The difference is I don’t have an alternative in the commodities asset class. I can’t take physical delivery of a train load of corn, or a truckload of cattle, or tanker of oil. But with Bitcoin, I can simply buy Bitcoin directly. If you have the option and you don’t do that I’d have to question that decision. The other issue that arises with these derivatives is there is so much capital moving around in those pools that it can cause the price of the actual asset to swing wildly. Gold investors have been squawking for decades about how the paper markets are not the same as the physical market and how the paper market manipulates the price in the physical market. They are not wrong about that either. Perhaps the same issues will arise with the Bitcoin derivative markets and spot Bitcoin. I’m not sure they are the same since Bitcoin can settle instantly (whereas other commodities cannot). This was one of the reasons the derivative markets were developed in the first place (for hedging and locking in prices). The derivative market has morphed however into a big gambling market with large actors making directional bets in massive size. We’ll see how it plays out.

- Commodities (14%) – Commodities are ‘real assets’ and are different than ‘financial assets’ in some ways. I think they are both fine. These days, however, with fiat money ballooning and interest rates seemingly artificially suppressed I think owning something more ‘real’ isn’t necessarily a bad thing. I’d rather not own commodities (versus stocks) for a variety of reasons. I will own them, however, if I believe stocks are expensive and commodities are cheap (or maybe simply unloved). I also keep an allocation to physical precious metals. I will likely always keep that as a ‘financial system/financial asset risk mitigation’ instrument (it is an insurance policy against financial assets). If financial assets get ‘cheap’ relative to commodities I might make the allocation smaller (or non-existent) and allocate it all to stocks. I’ve spent the last few years moving money out of the system (financial assets). The actions of the Fed and/or the passive bubble have valuations pegged. Games are being played with the global monetary system that no one on earth understands. I don’t like it at all and I’ve tilted my portfolio as far towards an ‘antifragile’ portfolio as I know how to implement. I’ve cranked down my exposure to equities/stocks and cranked up allocations to commodities, physical gold, physical silver, short-duration bonds (although I’ve closed those out now), and Bitcoin. I made these shifts to hedge against the unknowns of all the risk with the seemingly unlimited printing of fiat currencies. The system isn’t collapsing but it certainly feels broken. Even if it isn’t broken or going to collapse, I sleep better shifting my allocation the way I have.

- Broad Basket Commodity ETF (5%) – I own commodities begrudgingly. This is the most expensive investment in my entire investment portfolio (a .30% expense ratio). It also is very expensive due to the ‘roll’ where commodity contracts have to be rolled from one month to the next. Regardless, for the exposure I’m trying to manage it is very cost-effective. For why I own commodities at all (even though I’d rather not) and why $BCI is the investment of choice read here: https://deanorolls.com/2018/02/18/aberdeen-bloomberg-commodity-index-etf-bci/

- Physical Silver & Gold (9%) – I’d never owned precious metals at any point in my life until a few years ago. I’ve read enough and learned enough that I believe they have a place in the portfolio. I own physical silver and physical gold (in a vault), and some physical silver and junk silver coins (in a safe place closer to home). I use the silver-to-gold ratio if I’m reallocating and/or making new purchases. To read more about why I bought physical precious metals for the first time in my entire life (in my mid-40s) read here: https://deanorolls.com/2018/06/08/physical-gold-and-silver/

- Asset Classes I Don’t Use Right Now – I’m not currently allocated to these asset classes in my portfolio.

- Bonds (0%) – I generally don’t want an allocation to bonds/fixed income at all. I consider my future social security income to be ‘bond-like’ and this income (whatever it might be) is my bond position. I am investing for the long-term and bonds have not and will not outpace inflation over the long term (especially these days with artificially low rates). Trading bonds over the past few decades as rates have plummeted to the zero bound has worked well. If I did hold bonds it would not be to trade them. Therefore, I have no use for them. In early 2020, I had a larger allocation to short-duration bonds because I have 2-3 kids in college at the same time for the past few years (and the next few). I also have a decent amount of risk in my earnings related to my work/business (as it is still a closely held, startup). I don’t intend to use any funds from my investment portfolio to fund either of these (college or business) but I don’t want to be in the position of having to use my portfolio and having to sell depressed assets if I need the money quickly. So, I had a larger bond/fixed income allocation than I might normally have. This obviously changed and I have closed out this position to become ‘uncomfortably long assets.’ Again, “what happens if I’m wrong?” I might be but I’m prepared to live through that.

- Cash & Equivalents (0%) – I have a waterfall where I keep enough cash to pay my living expenses liquid. That money is not tracked as a part of my portfolio holdings. Once the waterfall is ‘full’ the money rolls (DeanoRolls?!?) into my portfolio for investment. If I hold cash at all it is because I am in-between positions (and holding time will be measured in days). I am investing for the long-term and Cash and Equivalents have not and will not outpace inflation over the long term. Therefore, I have no use for it.

- Asset Classes I Don’t Use (And Likely Won’t Ever) – I’ve researched all of these over the years (many quite considerably). I’ve determined they have no places for an allocation inside my portfolio. This doesn’t mean they are bad. They work very well for some people. They are just not my game.

- Real Estate (0%) – I generally don’t allocate/track my portfolio holdings to this. I can/will hold real estate as an asset (for example equity in a personal residence). I view this as more an expense than a portfolio holding (they don’t generate income and they take income to ‘feed’ them). Personal residence real estate is not an investment at all in my opinion. The equity in one’s home can be an important component of one’s net worth, however. Ultimately, I don’t like that real estate is hard to diversify, too illiquid, not tax-efficient (except for the personal residence exemption which is incredible), and very expensive to transact. Ultimately the way local governments tax real estate every single year for as long as you own it make it a NO GO for me as an investment. This tax treatment, for me, makes it a horrible investment. That said, they aren’t making any more of it either. Real estate is a piece of my portfolio allocation, for sure, as it is part of my net worth but not tracked here. I can/will own REITs or REIT stocks in my stock portfolio. If I ever decide to buy real estate for investment reasons, I will include it in my tracking but I do not see this happening at any point soon (but always researching). I am learning more and more about the tax advantages of owning various forms of real estate. At some point, I might expand this portion of my portfolio. But for now, pass, but interested.

- Options/Futures/Derivatives (0%) – I have no desire to participate in the derivatives market. I think this market is responsible for driving some portion of the unreasonable prices in traditional markets (like the stock market and precious metals markets). With options and futures, you have to get too much right to win. You have to get the direction correct AND the timing correct. That is too much and I say near impossible to do. I have exposure to this in my $BCI ETF for commodity exposure but I understand the strategy and the methodology (and it is what is necessary to gain long exposure to a broad-based commodity basket cost-effectively). I’ve researched putting a tail hedge strategy on my portfolio but found it is fairly expensive ‘insurance’. I’ve researched ways to implement a ‘long vol’ strategy in my portfolio but it is nothing that I am equipped to implement (and I’m not paying someone 2&20 to do it either). I’m not going to pay the necessary fees to have this strategy implemented by a manager/hedge fund. So, I’ll just go along for the ride. Pass, but still interested.

- FOREX (0%) – Currency hedging (or directional plays) is nothing I want any part of. I’ve researched the impacts currency moves can have on a portfolio and they can be considerable. Regardless, this is not anything I believe is important enough for me to allocate to within my portfolio. All the people on Instagram and Twitter showing how they make a few trades each day and drive a Lamborghini do not change my mind on this. My ultimate currency hedges are in my physical gold, silver, and Bitcoin positions. These are all currency-neutral. This asset class is not needed by me. Pass.

- Absolute Return (0%) – These are relatively expensive strategies (from both a fee and tax efficiency perspective) that are designed to provide absolute returns regardless of what happens in various markets. I don’t need to reduce my portfolio’s return volatility. I only need to maximize my portfolio’s size over time (ie. return). I do not need these types of products. If I think I’m going to need money short-term I’ll be sure to have it available. If the market gets crushed, and I experience a drawdown, I’ll just learn to live on less (I won’t be the only one doing that by the way). Pass.

- Annuities (0%) – An asset where you invest a lump sum of money in exchange for a steady stream of income throughout your lifetime. These carry financial institution risk and are usually very (very!) expensive. I’ll manage my lifetime income needs myself. Pass.

- Venture Capital / Private Equity (0%) – Most (not all…but most) of the people who run these investment products are some of the worst people I have ever met on the planet. Literally…the worst. I’ve never met more people I dislike more than in the halls of these institutions. Not to mention that the structure of these investments are some of the most convoluted on the planet. The reason despicable people make things unnecessarily complicated is to screw you over! I promise! The returns on most VC investments require losing a lot of money funding a lot of dogs to (hopefully) get a few winners. I don’t like that model at all. The returns on most private equity investments require excessive leverage and probably the ability to unload your investment on some other person later for a higher price. I don’t like either of those models at all either. I’ll gladly let other people deal with this herd of jerks. Deano out! Hard! Pass!

- Limited Partnerships (0%) – The structure of a limited partnership would have to be very appealing for me to ever enter into one of these types of investments. The main issue is with liquidity (or lack thereof) and with how capital is added to (or removed) from these entities. Way too complicated! Besides, I already have a partnership that works just fine for me with my wife of 25+ years. Pass.

- Hedge Funds (0%) – A hedge fund might include any/all of the above in them. Everybody and their mother has a hedge fund these days. No way I’d ever invest in most of the strategies they employee and if I did it would not be via a hedge fund. If there was a particular hedge fund that allowed me to implement a particular strategy that I deemed very important to implement I probably still wouldn’t invest in it. I believe there is no way to overcome the fee structure. The ONLY person getting rich in a hedge fund is the hedge fund. Pass.

The asset class allocation I have today is designed to take whatever the markets throw my way while giving me zero heartburn. I go this route because I know that I’m just along for the ride (like we all are). Whatever comes I am allocated in a way that I believe allows me to weather it. I am diversified for whatever comes but with a tilt for growing my net worth over time (and outpacing inflation). Investing is laying out money now to get more money back in the future–more money in real terms, after taking inflation into account. That is the entire goal of my enterprising investing activities.

I also think I may potentially prosper from the way I’m doing things. I am doing things that I believe will serve me better than the average person. My portfolio is not the portfolio that the typical American owns. I think this will serve me well.

I’ve learned I am an ‘enterprising investor’ but I also still invest with a bit of contrarian mixed in. I still make active decisions with my allocations. If I believe a particular asset class is over/undervalued I will allocate to it more (or less). I don’t mind wild price swings, however. These decisions are also made on a longer-term basis (annually-ish) so things are not moving quickly at all. I expect that if I’m doing it the way I intend, that most people will look at my portfolio and wonder why I’m doing certain things. “Why in the heck do you own that?!?” If someone is saying that to me, then that is exactly why I own it…because it is unloved. If it is unloved then, I believe, it is cheap and has more value to me as an investment.

Regardless, I don’t care too much about how all this plays out because I’m just along for the ride. Anyone who tells you they are not is 1) lying (and knows it), 2) lying (and doesn’t know they are–ignorant), or 3) an investment person who makes their living from it (likely fees from your account). That accounts for just about everyone in one way or the other. So, take what I say with a grain of salt. Hell, take what anyone says with a grain of salt. Do your own research and implement a plan that works for you. For me, this portfolio will do fine over time (no matter what). I suspect it will do better than my blended benchmark (so better than fine).

I recently read a great article from Warren Buffett that was written during the 2000 internet stock bubble (https://money.cnn.com/magazines/fortune/fortune_archive/1999/11/22/269071/index.htm). He talks about 1) interest rates and macro (and how no one can know the direction of all this), 2) investment fees (and those who earn them which he calls ‘helpers’), 3) how hard it is to pick winners (alpha), and 4) the importance of tax efficiency. These are all things I consider very important in investing. Warren Buffet knows a thing or two about investing too.

I believe all these things fully and this only further solidified my direction. We are all along for the ride in some areas but have total control over certain other areas. I’ve always been hyper-focused on fees. I’ve also always been hyper-focused on tax efficiency. I’m going to maintain a thoughtfully allocated portfolio, and remain hyper-focused on managing taxes/fees. I’ll try to get a little bit of alpha in the process (but I’m worried much less about this).

I’m becoming more and more comfortable with the Coffee Can approach. This is a concept of buying an asset and putting it in a coffee can on the shelf and never selling it…EVER! A few years ago, this concept was not one I would have embraced. I was constantly looking for new opportunities and weighing them against existing assets. I would constantly reshuffle. Now, however, I’ve moved away from this. I now allocate new capital into whatever I believe has the best value at that time (or whatever is most out of whack with my target allocations) and then stop. Full stop. Never do another thing again. Just let whatever is going to happen…happen. It is going to happen anyway no matter how much time/energy I spend thinking about it. If scenarios present themselves at some point, I am not opposed to reallocating capital but it is not something I wake up looking for each day, week, or month. I have several positions that I believe will be coffee can portfolio holdings in my portfolio. I’ll sell them if/when I need money in retirement, otherwise they’ll just sit there. An added benefit is this methodology is VERY tax-efficient (which is super, super important)! Another huge benefit is that it is easy. Set it and forget it. This leaves plenty of time for other things (see next paragraph).

I’ll spend my extra time running my company and more time hiking in the woods with my beautiful wife of 25+ years! I like the returns on THAT investment! Life is too short to spend it doing things that don’t have to be done. I invest a good deal of time in my investing because it is very important and I enjoy doing it. But there are ways to do it with less effort.

All this is subject to change next month, however! HA! That is the beauty of investing and what I like most about it. It is something I will always be able to do and learn about. I enjoy it very much. I’m sure at different times in my life my attitudes and strategy on how I invest will change. Each time they will build on the knowledge I’ve gained throughout my lifelong quest as an Enterprising Investor. I’ll likely keep writing about it as time goes on. I hope you find it somewhat helpful in some way (if you made it this far).

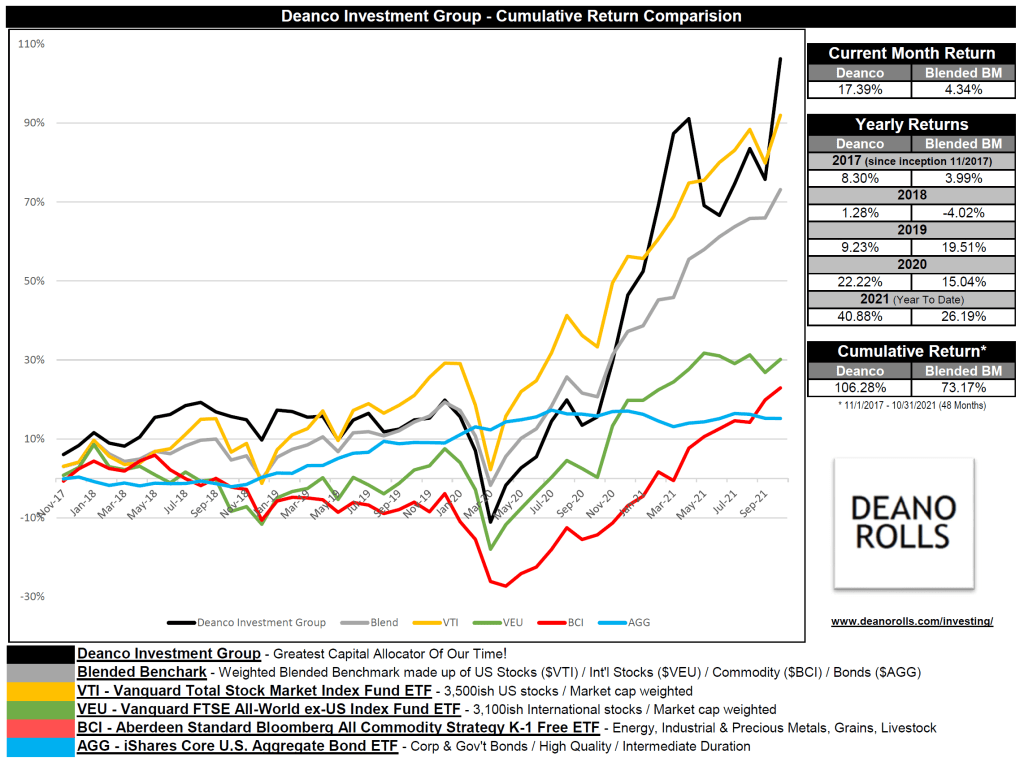

Part 4 – My Investment Performance

My goal, as an Enterprising Investor, is to beat the stock market over a long period (because IMHO it is the best asset class for real returns over long periods). Ultimately, I MUST beat my weighted blended benchmark, however.

The past few years have been a wild ride. Early on I started picking individual stocks to try to mitigate the risks that I perceived existed from “overpriced stocks”. This took a lot of time and energy. I won some and lost some. After doing it for a couple of years I decided I was wasting too much of my life force. I also learned that I was not going to be able to solve the problem of “overpriced stocks” by buying “not overpriced stocks”. I was fooling myself…and working myself very hard in the process. I converted my stock investing model in late 2019 and completed the transition in the third quarter of 2020. I have been completely happy with this new methodology. In essence, I have created my very own index fund. Time will tell if it is a good methodology or not.

When the COVID pandemic walloped the markets in March 2020 I was at the lowest cumulative return in the time I have been tracking everything. Since then, the financial markets have erupted higher with no sign of stopping at this time. At one point recently I was outperforming every index I compete against. A pullback in Bitcoin (and precious metals) has slowed me down recently. Frankly, this was to be expected. Things were moving a bit too quickly. You can’t win them all.

As I sit here at the 4-year mark I couldn’t be happier with where I’m at. I’ve had some good luck and some bad luck. Luckily the bad luck didn’t have too bad of an impact on my capital. I’ve changed courses a few times along the way. It took me a few years to get a system and portfolio management model that makes me feel comfortable. I’m there right now. Part of the warm fuzzy feeling is that I just ended my 4th year at an all-time high in cumulative return and dollar value. I’m beating every benchmark I track. That is my stated goal for Deanco Investment “Group” and I’m meeting it. I can’t complain about that at all. Even if that were not the case I’d still be very pleased with where things are right now. I feel like I have a good grasp on things right now. I spend what I feel like is the ‘right’ amount of time on all this. It doesn’t feel like work at all (although it is). I thoroughly enjoy the entire process.

I fully expect the portfolio will be volatile (potentially significantly volatile). I am prepared for that, however. All this wild volatility is THE definition of Uncomfortably Long Assets. It is no fun seeing these wild gyrations in one’s investment portfolio. But, I believe, it must be endured because asset prices will continue to rise (due to monetary inflation). I don’t think they can stop inflating the money so I don’t think it will stop. They have told us exactly what they are planning to do. I trust them (and I’m not a trusting person)!

- Indexes/Benchmarks – My goal is to beat “the market”. Am I doing that? That is a harder question to answer than you might think. There are indexes/benchmarks that track all kinds of different asset classes. I track returns for all of the major asset classes that I might invest in (US stocks, international stocks, commodities, and bonds). I don’t have access to the actual benchmarks, however. These are institutions for institutions and usually come at a price. This is fine. I replicate them using a DIY approach. I utilize representative index ETFs that are large and track each asset class (and that track indexes I want to measure against). This probably works better for me since ETFs have to incorporate their management expenses (as do I) so they are probably a more apples-to-apples comparison than a regular index. The difference between the two is very minor, however. My goal is to beat all the individual benchmarks (but especially stocks). I expect that over a long period stocks will outperform all the other asset classes. Stocks have historically been the best asset class to invest in for long periods to beat inflation and grow your capital. My goal is to beat stocks (which I think should beat everything else). I might not be invested in 100% stocks all the time but it is still my goal to beat stocks. If I do this it tells me if my class allocation decision-making is working. I’ve been told you can’t time the market consistently…but I will try. I will likely fail.

- Weighted, Blended Benchmark – My portfolio changes over time (as everyone’s does). Things go up and down all the time when the markets are open. One asset class might become a larger percentage of my portfolio (or smaller part) each hour, day, week, month, or year. This is when using a weighted, blended benchmark comes into play. As I calculate my performance each month I also calculate my allocation to each asset class. When I compare my portfolio’s return for the month to a benchmark I use those same weightings to build the benchmark’s return. Rinse, repeat, each month. My ultimate goal is to beat this weighted, blended benchmark since it measures how I should have done if I’d just purchased the associated ETFs. This tells me if my asset selection is working.

- Inflation – Whenever I think about inflation I think of the Capital One commercial “what’s in your wallet?” I think inflation is the same “what’s your inflation?” Of course, there is the official government statistic CPI. They constantly update how it is calculated to get it to show there is no inflation. Everyone knows it is worthless. Others might use the growth in the money supply (like M2 or M3), or the Fed’s balance sheet, or some other ‘inflation index’. There are a variety of different reasonable ways to measure inflation. Ultimately, however, inflation is different for everyone. It is when prices are going up for the things you are trying to purchase. If you are trying to buy a house, are paying for school, healthcare, or a car then those are your inflation. If you are trying to save for retirement and asset prices keep going up 20% a year that is your inflation. I want to be ahead of all that. If I stay invested in asset classes that historically outpace inflation over the long haul and through various cycles AND I don’t trade them through various parts of the cycle I’ll do fine. I am going to spend some time adding inflation indexing to my monthly reporting (or maybe yearly reporting) to be sure I’m beating inflation. I’ll look at various indicators someone might use to make sure.

- After Fee/Expenses Returns – My portfolio returns are displayed after fees and expenses since all fees (and commissions) are removed from the accounts that I use. Each asset I own has the investment expenses removed as well (so the prices reflect after investment expenses).

- After-Tax Returns – I don’t track an after-tax return. I would if I could keep track of it. Almost no one calculates after-tax returns due to the work required to keep track of it for each investment/investment account. It probably wouldn’t be hard for me to figure this out since I don’t transact often and I have the records. Regardless, it is not an industry standard and no one else does this so I won’t. I do manage my taxes very closely, however. I review this on each transaction and then also review everything when I file my taxes each year. I take taxes very seriously and hate paying them but the overhead of including them each month isn’t worth the effort. I’m not THAT big of a nerd!?!

Part 5 – What’s Next?

This is the stuff I think about. I don’t spend much time doing things that many people I know do. I’m a loser! I digest information to figure out how to allocate my investment capital and to be best positioned to survive and thrive whatever may come. Overall, I’m glad I’ve dedicated the time to it and consider it a big success. I’ve been doing decent at it over the past 4 years. I’ve learned an enormous amount about investing and what works and doesn’t work. I’ve learned an enormous amount about what are good uses of my time and what is a waste of my time. A few of the big things:

- Macro Is Hard – Trying to figure out macro is a complete waste of time…but you have to do it anyway. We are all along for the ride! Not a single person on this earth knows with any certainty what is going to play out in the financial markets. The global financial system is, in my opinion, the ultimate AI (Artificial Intelligence). It knows more than anyone else and prices that information into everything, all day, every day. We don’t have a chance at outdoing that. I try to remain educated on things and I have ideas on what I think may happen. I fully expect that none of that will do any good, whatsoever. Mr. Market will do what he/she wants. We are all along the ride! I direct my investment portfolio using my opinions, but I try to remain very diversified in case I am wrong. These days, I also try to spend as little time as I can on it. Life is too short to spend extra time trying to make an impact on something that you cannot have any impact on. I work hard to remain diversified, manage my fees, invest wisely, and manage my investment taxes. I can control those things, so I do. Come what may with the rest, I’ll be ready. The past year has been a good preview of what we might expect to happen in the future.

- Luck Meets Hard Work – People will think that if you win it is probably just luck! I think luck meets hard work. Let’s face it most people haven’t read this far. I know this, I see how many people read every post I publish. Maybe my posts just suck. It isn’t just my posts, however. Most people are not sitting down and doing deep thought/work on topics like this. Most people spend very little time thinking about something as important as how to allocate their life force (net worth). I’d argue that this is one of the most important topics in one’s life. How can you not dedicate an inordinate amount of time to it? Most people I know spend the majority of their time doing activities that are a complete waste of time. I’m not saying I’m better than them for being a complete dork and spending hours and hours thinking about nothing but this stuff. My wife makes fun of me for ‘playing on Twitter’ and I always correct her and tell her I’m ‘working on Twitter’. Ha! Taking hours and hours to write down my thoughts (that no one will read), calculate my performance, listen to podcasts, watch videos, seek out advice, etc. Doing all that homework and then naking tough decisions that put my capital at risk. Decisions to allocate capital towards generally out of consensus investments (because that is where the alpha might be). Sometimes these are gut-wrenching decisions. Decisions that if I am wrong will impair my capital and make me poorer. Many people won’t do any of those things. So please don’t tell me I’m lucky if/when all the work pays off. They’ll tell me how lucky I am but will have to turn off Netflix to tell me this, however. Uh, okay!?!

- Don’t Overthink It – The more time you spend on something the more you learn that you know a lot less than you think you did. Investing can be as hard or as easy as you make it. The more you peel the onion layers the more complicated it can get (and the more you begin to realize that it is very complicated). A lesson that comes up time and time again, however, is that it isn’t hard at all. The less you tinker with it the better is almost always the case. I’ve tried to develop a system that allows me to tinker a little to get that out of my system. But for the vast majority of my capital, it is left to sit and do whatever it is going to do. It is working well to keep both needs satisfied while keeping me from doing too many stupid things. I learn how to do this better and better each month I do this.

My thinking hasn’t changed too much at the moment from where I’ve been over the past year and a half. I’m not currently planning on making any major portfolio changes. This could change before I finish writing this, however?!? I ‘noodle’ on all this all the time. I generally post whatever I’m thinking about on Twitter. If I hear a podcast, video, or live stream that influences my thinking I’ll post it there. I use my Twitter as a way to keep track of my thoughts in real-time. I then review things over time to see if I need to make any adjustments to my portfolio based on what I’m thinking. Usually, the answer will be NO.

That’ll do it. If you made it this far [narrator: “no one did”], bless you! I wish you well on your investing journey.

Thanks,

Deano

10/30/2021

About Deanco Investment “Group”

I call all this effort Deanco Investment “Group”. There is no investment group, it is just me and my money. I’m just a normal guy who has a full-time job that is not in the field of investing (right now). However, I do have a finance degree and co-founded a fintech investment performance reporting company out of college (in the late 90s). I’ve always been interested in investing and doing it well. I’ve read many of the great investing books and built all kinds of tools/models (and fang-dangled spreadsheets). I’ve been super focused on my investing for the past four years. I began working hard to get my investments into assets that I believe will perform well in this crazy world we find ourselves in these days. I’ve learned a lot and changed strategies the more I’ve learned. It is why I like investing; you can always learn more than you know today and use your knowledge in your investing journey. I try to write down my journey each month and track my performance. It helps me to perform regular reviews on my investments. Since I’m doing them anyway, I figured I’d share. I try to share my investment portfolio, individual investments, and performance (good or bad) each month. This is my October 2021 update (48 months of tracking it).

Writing things down has been a game-changer. No one particularly gives a hoot about me or my money but the discipline of noodling on things and then writing down the thoughts regularly has been extremely helpful. It has also been excellent to be able to come back later and easily remember why I did a particular thing I did. I do this solely for myself but if you are interested you can read more here: https://deanorolls.com/investing/

I’d love to talk about investing with you. Link up with me on Twitter https://twitter.com/deanoroll5

Over the past few years, I’ve written a few articles that sum up where I’m at with my investing today. They (along with this year’s update) detail almost all of the lessons I’ve learned over the past 4 years pretty well.

- Bitcoin – Do I Still Want To Own It? – https://deanorolls.com/2021/03/09/bitcoin-do-i-still-want-to-own-it/

- I’m Uncomfortably Long Assets! – https://deanorolls.com/2020/12/01/im-uncomfortably-long-assets/

- What I’ve Learned (Or Relearned) About Investing Over The Past 3 Years! – https://deanorolls.com/2020/11/02/what-ive-learned-or-relearned-about-investing-over-the-past-3-years/

- The Top Things I Learned (Or Relearned) About Investing Over The Past 2 Years! – https://deanorolls.com/2019/12/08/the-top-things-i-learned-or-relearned-about-investing-over-the-past-2-years/

- Creating Deanco Investment Group – https://deanorolls.com/2017/10/31/creating-deanco-investment-group/